- Home

- Budget and Finance

- Funding Challenges and Solutions

Funding Challenges and Solutions

We are often asked, “Why does Gresham have so many budget challenges?”

- Rising costs

- Flat fees

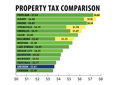

- State limits on property taxes

Gresham community members desire and deserve a full-service City organization with the resources to deliver exceptional services that support a high quality of life.

The City’s Financial Road Map is our plan to reliably supply core services.

Our temporary solutions

- Updated the monthly Police, Fire and Parks Fee to $15 to avoid service cuts.

- Used one-time American Rescue Plan Act (ARPA) funds to pay for immediate community and City priorities.

- Balanced the City budget for the fiscal year 2023-24.

- Approved the Gresham Financial Road Map.

The challenges Gresham faces

Gresham's financial future

- How We Got Here

- Council Meetings and Discussion

- Contact

Gresham is a place we are proud to call home. From our small-town feel with big-city conveniences to the green trees and rolling hills, friendly neighbors, charming centers and vibrant cultural diversity.

As a Gresham resident, you pay taxes and fees. The City uses these dollars to supply core services you need to live your life safely, including fire and police.

Because of Oregon’s property tax limits, frozen since 1991, Gresham struggles to pay for and maintain life-saving public safety services for this fast-growing community.

City strategy

- Advocating for action at the state level with partners to address property tax challenges.

- Reviewing current and ideal future needs; staffing levels, budget.

- Evaluating revenue tools both existing (Police, Fire and Parks fee) and new, a levy, bond measure or special district.

- Including community priorities in the Gresham Strategic Plan.

- Checking in with City Council at key milestones for direction.

Steps taken so far

- Gresham voters approved the Fire and Police Levy in May 2024, offering a historic level of support to Police and Fire services. Thank you, community members!

- Updated the Police, Fire and Parks Fee, originally established in 2012, to $15 a month to better cover rising expenses.

- Extended the Rockwood-West Gresham Urban Renewal District another six years, to 2029. Thank you, Gresham!

- Approved a five-year utility rates package for future certainty that started in January 2023.

- Reviewed utility bill assistance needs with a community survey. Added $220,000 in community assistance using ARPA funds

- Stabilized the organization's budget gap for two years using one-time American Rescue Plan Act funds. Those funds will be fully allocated by Dec. 31, 2024.

- Held City Council briefings on the property tax system, revenue options and financial forecast.

The City Council is considering options to raise a minimum of $28.2 million to stabilize the City’s financial forecast by the fiscal year 2025-26.

Council meeting agendas and videos.

The Financial Road Map outlines the revenue tools needed to reduce the projected deficit between revenue and expenses and to improve service delivery.

Budget and Finance Department

503-618-2445

Budget&Finance@GreshamOregon.gov